Ways to pay down your mortgage principal faster 1. Finally, some lenders may charge fees for additional principal payments or early payoff.

And if you lack an emergency fund, you should think twice before you put an unexpected cash infusion toward your mortgage. Putting extra money toward your mortgage can also hinder your ability to pay off debts with higher interest rates. You’re using money you could spend on alternatives, like a vacation or a nicer car or could be earning interest if invested elsewhere. Paying down principal requires discipline and dedication for long-term benefits. Drawbacks to paying down your principal early You could potentially save thousands of dollars in interest over the life of your loan by paying down your principal faster. As your principal balance decreases, your interest goes down as well. The amount of interest you pay each month is calculated using your principal balance. Without the ongoing monthly mortgage payment, you’re a big step closer to financial freedom. But paying off a mortgage early also gives you peace of mind. Enjoy peace of mindįor many people, the feeling of accomplishment that comes after your payoff is second to none. Whether you need to add a mother-in-law suite to accommodate an aging parent or cover some unexpected medical expenses, your chances of being approved for a home equity line of credit (HELOC) can improve when you have sufficient equity or own your home. Once your home loan has sufficient equity or is paid in full, you may be able to tap into your home's equity. While homeownership is certainly not a magical solution, paying your mortgage off early eliminates a large expense that you would otherwise face during a crisis. Recessions, pandemics and job loss all have the potential to cause people to fall behind on monthly payments. For example, you can pay off other debts, contribute more to retirement or invest the money. You can begin funneling the money you were putting toward your mortgage to other things. Once you make your final mortgage payment, your cash flow immediately improves. Here are some of the benefits of reducing your principal and paying off your mortgage early: You can devote cash to other things The portion of your payment devoted to the principal, on the other hand, may seem surprisingly small.

Phone payments: You can call your lender to make an additional payment toward your principal.Select that option and specify your amount and date.

Many lenders offer the option to put money toward your principal. Online payments: If you’re set up with online banking, sign in to your account and look for a button or option that allows you to make a payment.

MORTGAGE CALCULATOR EXTRA PAYMENT PRINCIPAL HOW TO

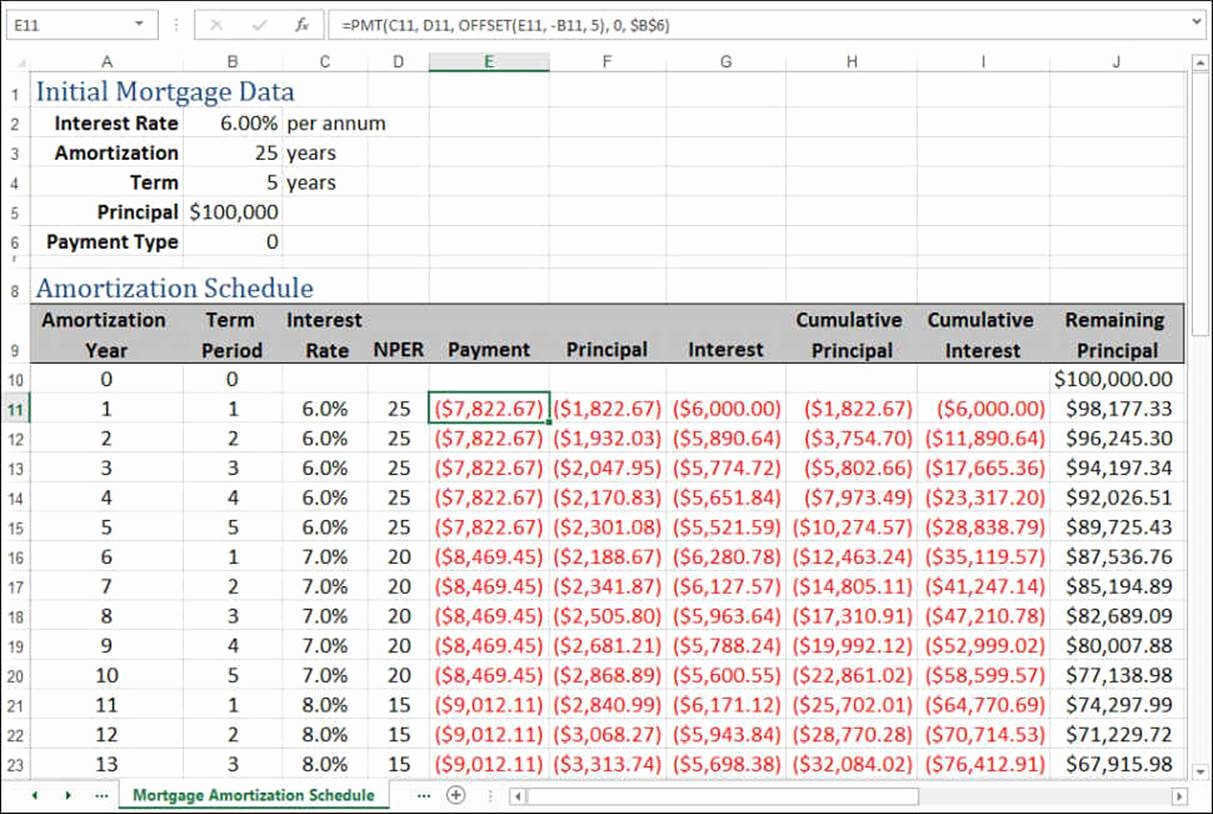

Regardless of how you make your mortgage payment, here’s how to make sure the extra dollars you contribute go towards principal: If you don't make this clear, you may find the extra payment going toward the interest you owe rather than the principal. The key is to specify to your lender that you want your extra payments to be applied to your principal. Making additional principal-only payments on your mortgage can reduce the amount of interest you pay and also help you pay your loan off sooner. The thought of paying hundreds or thousands of dollars a month for decades can be overwhelming. Like many homeowners, your mortgage payment can be your largest monthly expense. At the top of this list is your monthly mortgage payment. But there are many responsibilities that come along with owning a home. There's nothing like receiving the keys to your home, especially after you’ve worked so hard to save for a down payment and qualify for a loan.

0 kommentar(er)

0 kommentar(er)